Unlocking Wealth: Real Estate Investment Strategies for Millennials in 2025

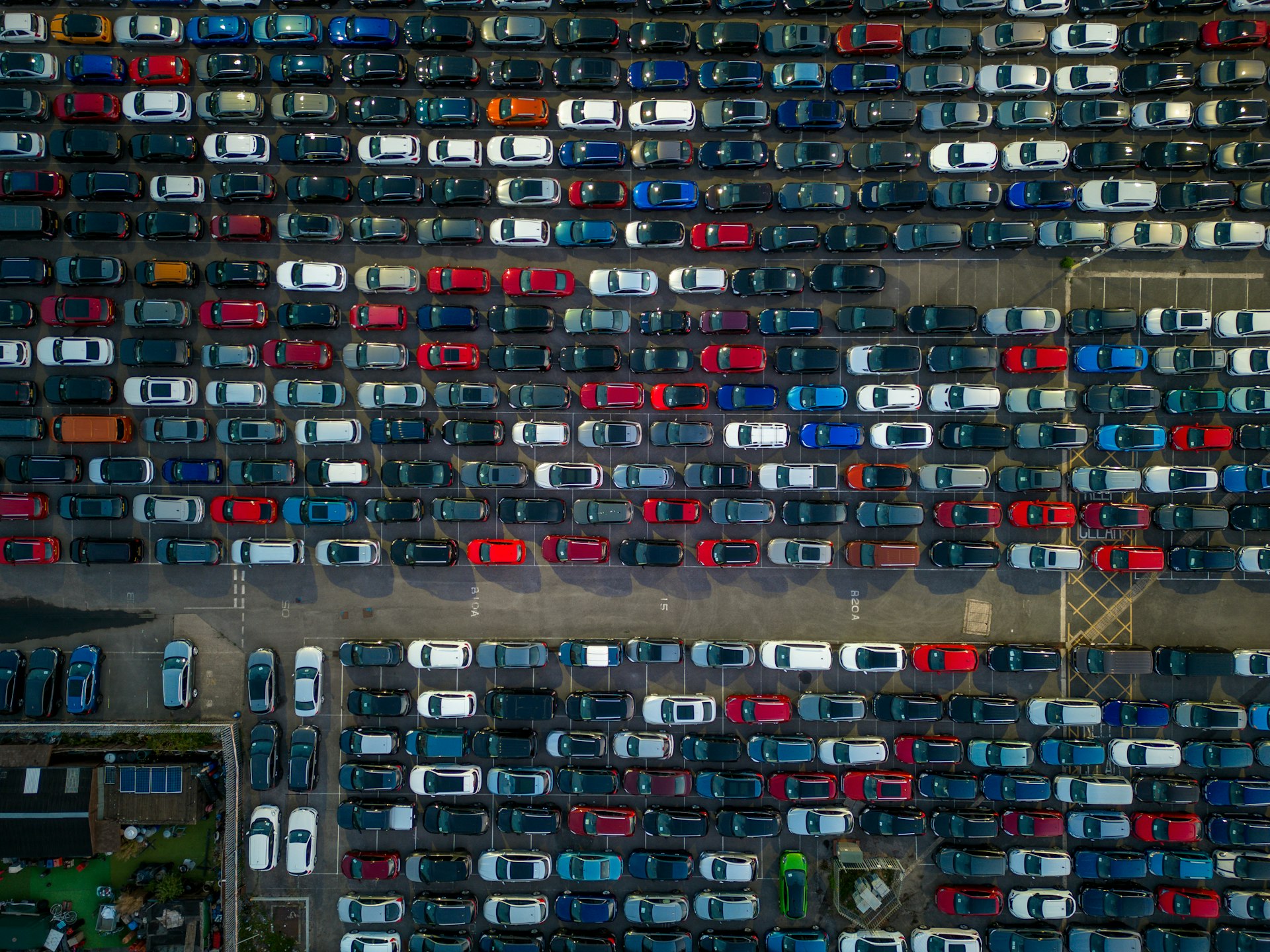

Photo by Vitaly Gariev on Unsplash

Introduction: Why Millennials Are Turning to Real Estate

In recent years, millennials have emerged as a powerful force in the real estate market, using innovative strategies to build wealth and achieve financial independence [1] . Despite economic hurdles such as student debt and rising home prices, this generation is leveraging technology, financial literacy, and alternative approaches to make property investment accessible and rewarding. This article provides a comprehensive guide for millennials interested in real estate investment, offering practical steps, real-world examples, and actionable advice to navigate today’s market.

Understanding the Millennial Financial Landscape

Millennials-those born between 1981 and 1996-face unique economic challenges. Many entered the job market during the Great Recession and were further impacted by the COVID-19 pandemic, resulting in delayed homeownership and investment [3] . High student loan debt and historically high housing costs have made traditional paths to property ownership more difficult. Yet, millennials are also more financially literate and tech-savvy than previous generations, eager to diversify their income and build long-term security.

According to the National Association of Realtors®, millennials have become the largest group of homebuyers in recent years, and data from the U.S. Census Bureau shows a gradual increase in homeownership rates among younger Americans [1] . However, nearly half of millennials still do not own homes, and many expect to inherit property as their entry point into the market [5] . Understanding these factors is crucial for developing a tailored investment strategy.

Top Real Estate Investment Strategies for Millennials

1. Buy and Hold for Long-Term Gains

The traditional “buy and hold” approach remains a reliable way to build wealth. This involves purchasing a property-often in a high-growth area with strong job markets and increasing population trends-and renting it out for steady cash flow and appreciation over time [4] . For example, a millennial investor might purchase a duplex in a growing suburb, live in one unit, and rent the other. Over several years, the property’s value may rise, and rental income can help cover the mortgage and generate profit.

To implement this strategy, consider starting with a Federal Housing Administration (FHA) loan, which allows for lower down payments. Research local markets using real estate platforms, consult with licensed agents, and review population and job growth data to identify promising neighborhoods.

2. House Hacking

House hacking is especially popular with millennials looking to offset living costs. This involves buying a multi-unit property, living in one unit, and renting out the others. The rental income can cover a significant portion of the mortgage, helping you build equity and reduce your cost of living [4] . For instance, a millennial buyer might purchase a triplex, live in one apartment, and rent out the other two-using the income to pay down the loan faster.

To get started, work with a lender experienced in multi-family properties and seek advice from local investor groups. Online forums and social media groups focused on real estate investing often provide practical tips for first-timers. Always check local zoning laws and rental regulations before purchasing.

3. Real Estate Investment Trusts (REITs)

For those who want exposure to real estate without the responsibility of property management, REITs offer a hands-off investment option. REITs are publicly traded funds that invest in income-producing real estate. They provide dividends and potential appreciation, making them suitable for passive investors [4] . Millennials can purchase shares of REITs through brokerage accounts, gaining diversification across various property types such as commercial buildings, apartments, and healthcare facilities.

To access REITs, open an account with a reputable brokerage-many offer educational resources tailored to new investors. Compare expense ratios, dividend yields, and historical performance before buying shares. Remember, while REITs can offer stability, returns are not guaranteed and may fluctuate with market conditions.

4. Short-Term Rentals and Airbnb Investing

The rise of platforms like Airbnb has enabled millennials to earn income from short-term rentals. Purchasing property in vacation hotspots or urban centers that attract business travelers can lead to significant profits. However, local regulations governing short-term rentals vary widely and can impact profitability [4] .

Before investing, research city ordinances and neighborhood associations for restrictions on short-term rentals. Calculate potential occupancy rates and maintenance costs. Successful investors often automate guest communications and cleaning to streamline operations. If you encounter regulatory hurdles, consider medium-term rentals targeting traveling professionals or students.

5. Fix and Flip Properties

Flipping involves buying undervalued homes, renovating them, and selling for a profit. This strategy requires capital, project management skills, and a keen understanding of market trends. Successful flippers purchase homes below market value, make cost-effective improvements, and list the property when demand is high [4] .

To mitigate risk, assemble a team of trusted contractors, obtain multiple renovation bids, and build a detailed budget. Attend local real estate investor meetups or workshops to learn from experienced flippers. Be prepared for unexpected expenses and always factor in holding costs, such as taxes and utilities, during the renovation period.

6. Real Estate Mutual Funds and Diversification

Diversifying across residential and commercial properties can help reduce risk. Real estate mutual funds let you invest in a range of assets without direct ownership responsibilities [2] . These funds are available through major brokerage firms and can be a stepping stone for those just starting out.

To begin, compare fund objectives, management fees, and performance history. For additional diversification, combine mutual funds with direct property investments or REITs. This approach spreads risk and increases exposure to different market segments.

Overcoming Barriers: Accessibility and Wealth Transfer

Despite the appeal of real estate, barriers such as high entry costs and limited credit can be daunting. Many millennials are overcoming these challenges by co-investing with friends or family, using online crowdfunding platforms, or participating in co-ownership arrangements [3] . For those expecting an inheritance, planning is essential: experts recommend working with an estate planner to ensure a smooth transfer of property and minimize tax liabilities [5] .

Photo by Vitaly Gariev on Unsplash

To improve accessibility, consider the following steps:

- Build your credit score by paying bills on time and reducing debt.

- Save for a down payment using high-yield savings accounts or retirement account loans (consult a financial advisor first).

- Research local and state first-time homebuyer programs-these can offer down payment assistance, lower interest rates, or tax credits. Visit your state housing finance agency’s official website or contact a HUD-approved housing counselor for guidance.

- If inheriting property, consult an estate planning attorney to understand your rights and responsibilities.

Emerging Trends: Sustainability and Digital Infrastructure

As of 2025, sustainability is a major focus for both investors and renters. Eco-friendly buildings and energy-efficient upgrades increase property value and attract environmentally conscious tenants [2] . Digital infrastructure is equally important: properties with high-speed internet and smart-home features are in high demand, particularly for remote workers and online businesses.

When evaluating investment properties, prioritize those with green certifications, efficient appliances, and modern connectivity. Grants and tax incentives for sustainability upgrades may be available-check your state’s department of energy or housing authority for current programs.

Step-by-Step Guide: Getting Started as a Millennial Investor

1.

Assess Your Financial Readiness:

Review your credit, debt, and savings. Use online calculators to estimate affordability.

2.

Define Your Investment Goals:

Decide whether you want passive income, long-term appreciation, or a mix. Select a strategy that aligns with your financial situation and lifestyle.

3.

Research Local Markets:

Use real estate platforms to analyze market trends, rental rates, and growth potential. Consult with local agents for insights.

4.

Secure Financing:

Compare mortgage rates from multiple lenders. Explore FHA, VA, and conventional loan options. Gather required documents such as proof of income and credit reports.

5.

Start Small:

Consider house hacking, co-investing, or REITs if buying a property outright isn’t feasible. Build experience and equity gradually.

6.

Network and Learn:

Join real estate investment groups, attend workshops, and seek mentorship from experienced investors. Online communities and local meetups are valuable resources.

7.

Monitor and Adapt:

Track your investments, stay informed about market changes, and adjust your strategy as needed. Consider working with a certified financial planner for personalized guidance.

Key Takeaways and Next Steps

Real estate investment remains a powerful tool for millennials seeking to build wealth and secure their financial futures. By embracing innovative strategies, overcoming market barriers, and leveraging technology, millennials can turn property investment into a core part of their financial plans. Whether through house hacking, REITs, co-investing, or sustainability-focused upgrades, the opportunities are numerous and adaptable.

To take the next step, start by researching your local housing market, contacting a licensed real estate agent familiar with first-time buyers, or exploring online investment platforms with educational resources. If you’re interested in down payment assistance or homebuyer education, visit your state housing finance agency’s official website or consult a HUD-approved counselor. With careful planning and informed decision-making, millennials can unlock the wealth-building potential of real estate.

References

- [1] SFMC Home Lending (2024). How Today’s Young Buyers Are Using Real Estate to Build Wealth.

- [2] Farther Finance (2025). Real Estate Investing Strategies Explained In 2025.

- [3] Balboa Wealth (2024). Is Real Estate the Millennial Goldmine? Smart Investment Strategies.

- [4] Frank Albert Realty (2025). Top 7 Real Estate Investment Strategies for 2025.

- [5] Primior (2025). The Hidden Truth About Wealth Transfer Strategies In Real Estate.

MORE FROM smartsavingsfinder.com