Unlocking Vacant Land Investment Opportunities: A Comprehensive Guide for Smart Investors

Photo by Lucas Oliveira on Unsplash

Introduction: Why Consider Vacant Land Investment?

Vacant land is often overlooked as a real estate investment, yet it offers unique advantages for individuals seeking long-term growth, diversification, and a relatively hands-off approach. Unlike developed properties, vacant land typically requires little maintenance, incurs lower holding costs, and can appreciate significantly as population and demand increase [1] . In this guide, you’ll learn how to identify, evaluate, and access vacant land investment opportunities, along with practical steps and proven strategies to maximize your returns.

Understanding the Benefits of Vacant Land Investment

Long-Term Appreciation: Vacant land generally appreciates over time, especially in growing regions. As land becomes scarcer due to urban expansion and population growth, its value tends to rise, offering investors the potential for substantial capital gains [1] .

Low Maintenance and Holding Costs: Since vacant land has no structures, there are minimal maintenance demands, no tenant issues, and property taxes are often much lower than improved properties [4] . This makes land an attractive, low-overhead asset.

Diversification: Adding land to your portfolio helps diversify your investments, reducing overall risk. Land behaves differently from other asset classes and can serve as a hedge against inflation.

Flexibility and Multiple Exit Strategies: Vacant land can be held for appreciation, developed for residential or commercial use, leased for agricultural or recreational purposes, or flipped for profit [3] .

Tax Advantages: In some cases, land investment offers tax benefits, such as deductions for property taxes or favorable capital gains treatment upon sale. Consult a tax professional for details specific to your situation.

Types of Vacant Land Investment Opportunities

There are several ways to invest in vacant land, each with unique risk and reward profiles:

- Buy and Hold: Purchasing land in strategic locations and holding it for future appreciation. This approach is favored by investors who want minimal involvement and are willing to wait for long-term gains [1] .

- Land Flipping: Acquiring undervalued parcels, improving them (such as clearing, grading, or securing zoning changes), and selling for a profit. This strategy requires market knowledge and active management [3] .

- Development: Purchasing land to develop for residential, commercial, or industrial purposes. This is a capital-intensive approach but can yield significant returns if market demand is strong.

- Leasing: Leasing land for agriculture, recreation (hunting, camping), or commercial uses such as billboards or cell towers. This provides a steady income without selling the asset.

- Specialty Niches: Investing in land suitable for self-storage facilities, mobile home parks, or short-term rentals can offer recession-resistant income and less competition [3] .

How to Identify High-Potential Vacant Land Opportunities

Finding the right parcel is critical to your investment’s success. Here’s how to approach the search:

Conduct Thorough Market Research: Use online platforms like Zillow and Realtor.com to explore listings, track prices, and identify regional trends. Check local government websites for information on zoning, planned developments, and infrastructure projects [3] .

Analyze Location and Accessibility: Proximity to cities, highways, utilities, and schools can significantly impact land value. Look for areas experiencing growth or slated for new developments.

Assess Zoning and Land Use: Determine current zoning and potential for rezoning. Land with flexible zoning or the possibility for development is typically more valuable. Consulting with zoning officials or a land use attorney is recommended [2] .

Verify Utilities and Infrastructure: Access to water, electricity, and sewage increases both usability and marketability. If utilities are not available, research the cost and feasibility of bringing them to the property.

Engage a Professional Appraiser: Before committing, hire a certified appraiser to evaluate the land’s value, considering factors like topography, access, comparable sales, and market conditions [2] .

Maximizing Value: Improving and Managing Vacant Land

Enhancing your land’s value can lead to higher returns. Consider these practical steps:

Infrastructure Improvements: Clearing, grading, or adding access roads can make the property more attractive to buyers or developers. Adding utilities, even if just access points, can also boost value.

Zoning Changes and Variances: Applying for rezoning to allow for more lucrative uses (e.g., changing agricultural land to residential use) can significantly increase value and marketability [2] .

Professional Management: Consider working with a property management or real estate firm experienced in vacant land to handle maintenance, leasing, or sale negotiations.

Alternative Uses: Explore leasing options for agricultural, recreational, or commercial purposes. For example, some investors lease land for solar farms or cell towers, creating passive income streams.

Financing and Tax Considerations

Financing Options: Financing vacant land is different from traditional real estate. Some banks offer land loans, but terms may be stricter and require larger down payments. Seller financing is often available and can be more flexible. If you have retirement savings, consider using a self-directed IRA for land investments [5] .

Tax Implications: Property taxes on vacant land are usually lower than on developed properties, but rates vary by location. Consult with a tax advisor to understand deductions, capital gains treatment, and how land fits into your broader tax strategy.

Step-by-Step Guide: Accessing Vacant Land Investment Opportunities

- Define Your Investment Goals: Are you seeking long-term appreciation, passive income, or development potential? Clarifying your objectives will guide your search.

- Conduct Market Research: Use reputable real estate platforms, consult local government offices for zoning and development plans, and connect with real estate professionals specializing in land.

- Screen and Evaluate Properties: Assess location, access, zoning, and utility availability. Visit properties in person whenever possible.

- Engage Experts: Work with appraisers, land use attorneys, and real estate agents experienced in land transactions to ensure due diligence.

- Secure Financing: Research lenders offering land loans or explore seller financing. If using a self-directed IRA, consult a qualified custodian [5] .

- Negotiate and Close: Make an offer based on market value and potential improvements. Complete necessary inspections, title searches, and legal reviews before closing.

- Consider Improvements: Implement cost-effective upgrades or pursue rezoning to enhance value and marketability.

- Plan Your Exit Strategy: Decide whether to hold, develop, lease, or sell based on market conditions and your goals.

Overcoming Common Challenges in Vacant Land Investing

Limited Financing Options: Vacant land loans often require higher down payments and shorter terms. Building relationships with local banks, exploring credit unions, or negotiating seller financing can help.

Zoning and Permitting Risks: Rezoning can be a lengthy and uncertain process. Consult local zoning offices and consider engaging legal counsel to navigate regulations.

Market Liquidity: Selling vacant land can sometimes take longer than selling developed properties. Enhancing the property’s appeal and working with experienced brokers can speed up transactions.

Alternative Approaches: Creative Land Investment Strategies

Opportunity Zones: Some regions offer tax incentives for investing in designated opportunity zones. These programs may allow you to defer or reduce capital gains taxes; details can be found on the Internal Revenue Service’s official website by searching for “Opportunity Zone program.”

Real Estate IRAs: Using a self-directed IRA to invest in land can diversify your retirement portfolio and provide tax-deferred or tax-free growth [5] .

Joint Ventures and Partnerships: Teaming up with other investors or developers can help pool resources and expertise, reducing risk and increasing potential rewards.

Getting Started: Practical Steps and Resources

To launch your vacant land investment journey:

- Identify your budget and investment horizon.

- Use online real estate platforms, connect with local land brokers, and attend real estate auctions.

- Visit local planning or zoning offices for up-to-date regulations and development plans.

- Consider joining real estate investment associations or online forums for peer insights and networking.

- Engage relevant professionals (appraisers, attorneys, agents) as needed for due diligence.

Remember, patience and thorough research are key. Vacant land investment can be a powerful addition to your wealth-building strategy, provided you approach it with diligence and an eye for opportunity.

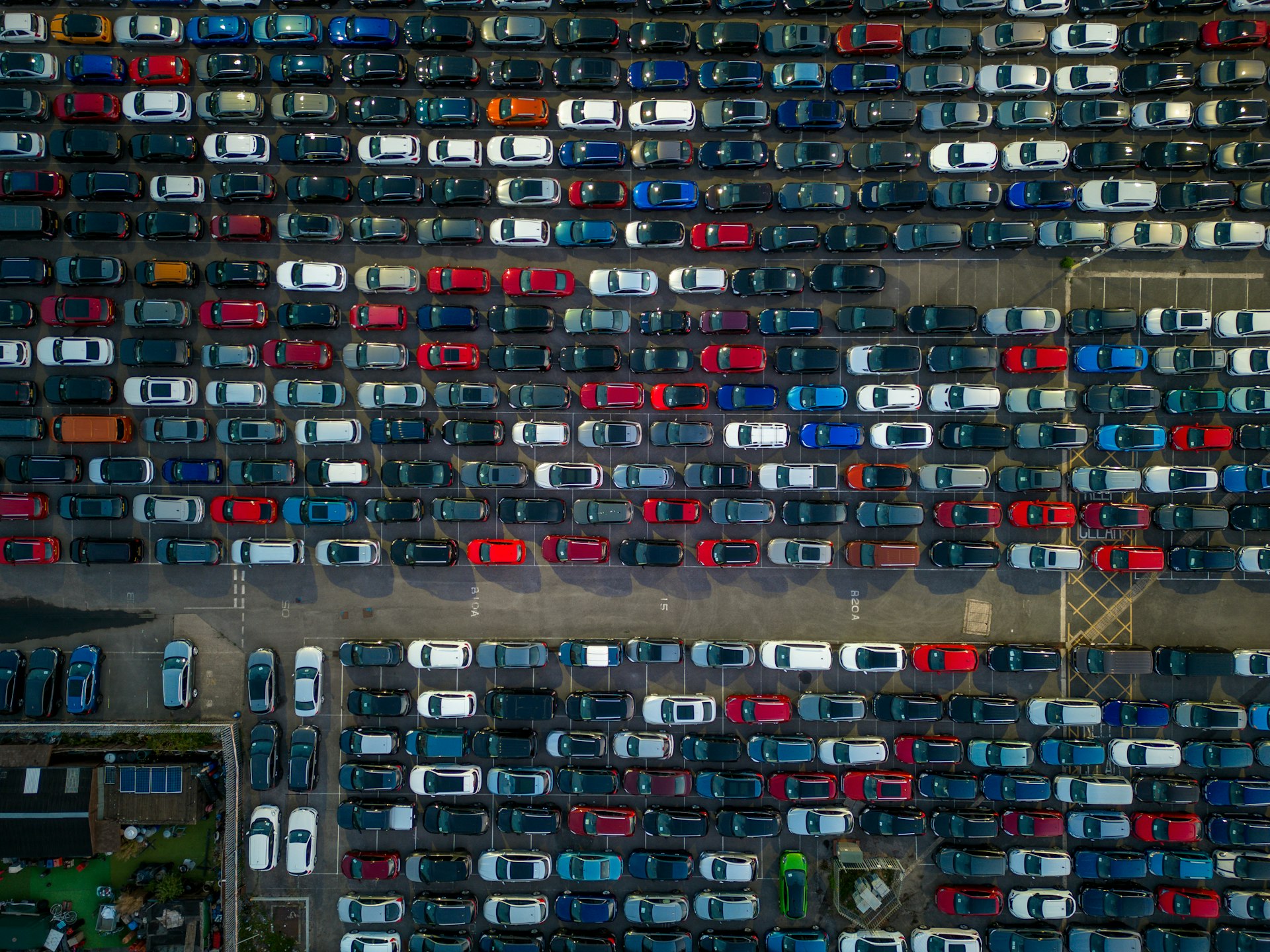

Photo by Joseph Mugo on Unsplash

References

- [1] LandLeader (2023). Buying Vacant Land: A Smart Investment for the Future.

- [2] Austin & Austin Appraisal Services (2023). The Complete Guide to Vacant Land Appraisals for Investment.

- [3] Rentastic (2023). How to Buy and Flip Vacant Land for Maximum Returns?

- [4] APXN Property (2024). How to Invest in Raw Land and Make Money in 2024.

- [5] Advanta IRA (2024). The Ultimate Guide to Raw Land Investing Using a Real Estate IRA.

MORE FROM smartsavingsfinder.com