Unlocking Opportunity: How Climate Finance and Carbon Markets Drive Global Impact

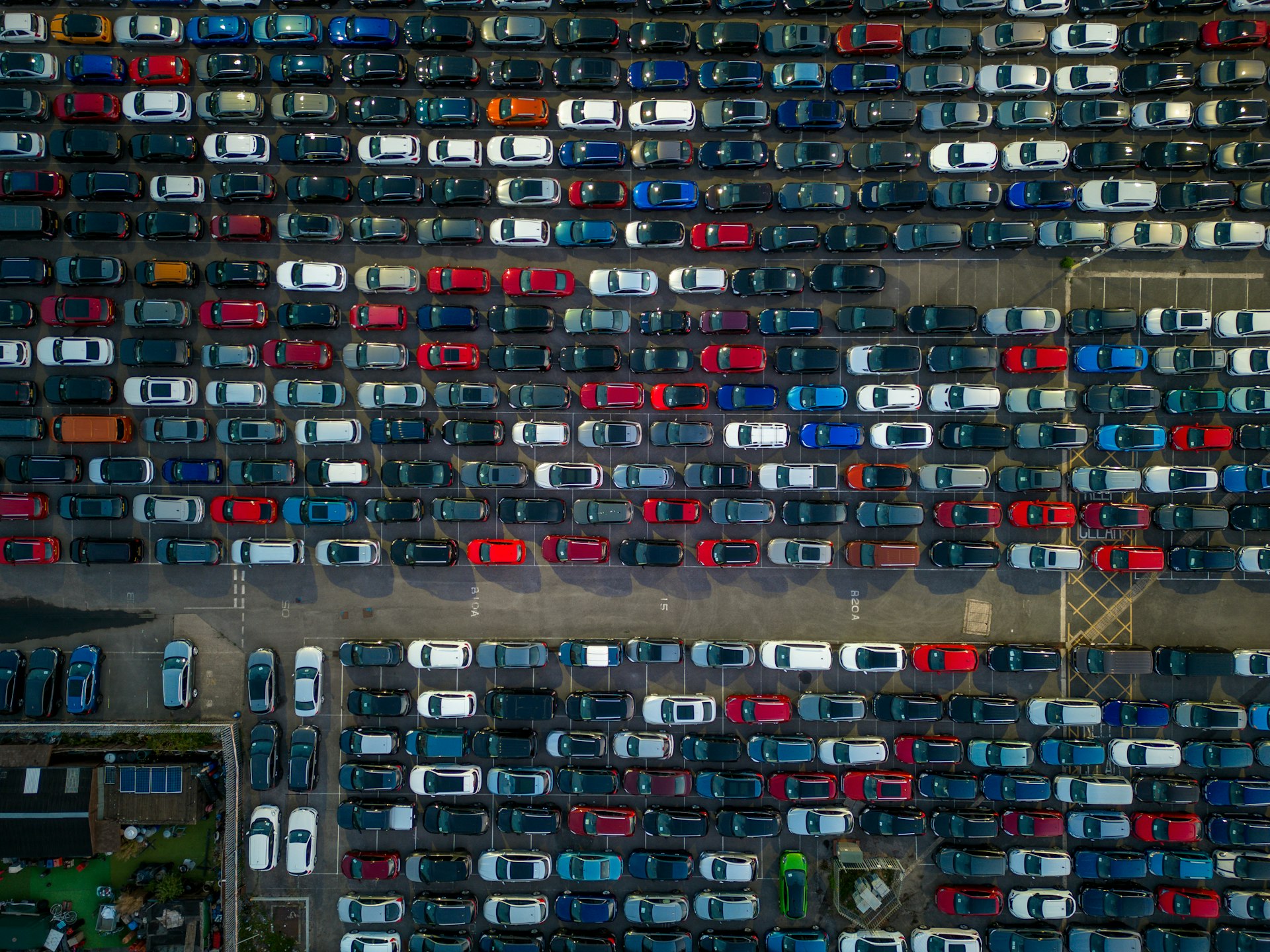

Photo by Documerica on Unsplash

Introduction: A Pivotal Era for Climate Finance

Climate finance and carbon markets are entering a transformative phase, with 2025 poised as a defining year for global collaboration, regulatory clarity, and investment in climate action. As the world faces urgent calls to limit warming and adapt to climate risks, these mechanisms are evolving from niche initiatives into mainstream financial infrastructure-offering powerful tools for organizations, governments, and individuals to reduce emissions, foster innovation, and unlock sustainable growth. [1]

What Are Carbon Markets?

Carbon markets are systems where greenhouse gas emission reductions or removals are quantified into carbon credits, which can be bought and sold. These credits are generated by projects that lower emissions or remove carbon from the atmosphere-such as reforestation, wetland restoration, switching to renewable energy, capturing methane, and improving energy efficiency in buildings and industry. [3] Carbon credits are verified under established standards and can be traded to help buyers meet climate goals.

There are two primary types of carbon markets:

- Compliance markets : Mandated by laws or regulations, these require entities to reduce emissions or purchase credits to meet regulatory targets. Examples include the European Union Emissions Trading System and the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

- Voluntary markets : Here, companies, governments, and even individuals buy credits to meet self-imposed climate targets or demonstrate climate leadership. [3]

High-integrity markets are essential. Well-designed systems with rigorous standards and transparency can raise significant funds for building low-carbon economies, while also ensuring positive social and environmental impacts. [2]

Photo by Andreas Felske on Unsplash

How Climate Finance Works in Practice

Climate finance refers to investments and funding that support mitigation (emissions reduction) and adaptation (resilience-building) activities. Carbon markets are a central channel for mobilizing these funds, often enabling private sector investment in projects that might otherwise lack sufficient capital. [4]

For example, a renewable energy developer may generate carbon credits by constructing wind farms in an emerging economy. These credits are sold on carbon markets to businesses seeking to offset their own emissions, providing the developer with revenue to expand operations. Similarly, forest owners can participate in carbon markets by maintaining and enhancing natural carbon sinks, earning income from credit sales while supporting conservation. [5]

How to Access Climate Finance and Participate in Carbon Markets

Engaging with climate finance and carbon markets involves several steps, whether you are an organization, government, or landowner:

- Identify Your Emissions Profile or Project Potential: Assess your organization’s carbon footprint or identify land/activities suitable for generating verified emission reductions (e.g., reforestation, renewable energy, methane capture).

- Choose the Appropriate Market: Determine whether to participate in a compliance or voluntary market. Many companies opt for voluntary markets to complement internal reduction efforts.

- Engage with Established Standards: Select a carbon standard or registry recognized for integrity, such as Verra’s Verified Carbon Standard, Gold Standard, or national mechanisms. Research which standards are most accepted in your region and sector.

- Develop and Register Your Project: Work with technical experts to design, implement, and monitor your project according to the requirements of your chosen standard. Registration typically involves baseline studies, third-party verification, and ongoing monitoring.

- Sell or Purchase Carbon Credits: Once verified, credits can be sold to buyers seeking to offset emissions or fulfill regulatory obligations. If you are a buyer, select credits from high-integrity projects aligned with your sustainability goals.

- Ensure Co-Benefits and Safeguards: High-integrity credits increasingly require social and environmental co-benefits, such as biodiversity conservation, community development, or climate resilience. Ensure your project meets these criteria for broader impact and market acceptance. [2]

For detailed guidance, you can consult the United Nations Development Programme (UNDP), which provides resources and strategic support for project developers and governments. Visit the official UNDP website and search for “carbon market support” or contact the relevant national climate finance authority in your country. [2]

Recent Developments and Case Studies

The agreements at COP29 marked a major advance by establishing a global governance framework for carbon markets, particularly under Article 6 of the Paris Agreement. This shift enables countries to trade credits internationally, opening new finance streams for both governments and private actors. [4] For example, bilateral deals under Article 6.2 are allowing countries to tailor trading arrangements to local needs and accelerate project implementation.

Airlines are now participating in large-scale credit purchases for compliance with CORSIA, bringing institutional buyers into the market and raising the bar for credit quality and transparency. [1]

Case studies highlight that companies active in carbon markets tend to invest more in emissions reduction and achieve their sustainability targets faster than those that do not participate. [5] Forest projects verified under reputable standards not only sequester carbon but also deliver biodiversity and community benefits, illustrating the multi-dimensional impact of high-quality credits.

Challenges and Solutions

While the growth of carbon markets offers promise, there are challenges to navigate:

- Complexity and Regulatory Uncertainty: Governments and project developers must stay informed about evolving rules and standards. Many organizations provide technical assistance-consider consulting the UNDP or national climate agencies for up-to-date guidance. [2]

- Ensuring Integrity: The risk of low-quality or fraudulent credits can undermine trust. Prioritize credits verified under robust, transparent standards with independent third-party audits.

- Access for Developing Countries: Many developing economies face barriers to entering carbon markets. International organizations are expanding support and capacity-building programs-search for “carbon market readiness” or “climate finance support” through reputable agencies and NGOs.

Solutions include choosing well-established registries, seeking technical partnerships, and focusing on projects with clear social and environmental benefits alongside carbon reduction.

Alternative Approaches to Climate Finance

Carbon markets are one tool among many. Organizations and governments should also explore:

- Green Bonds: These debt instruments raise funds specifically for climate mitigation and adaptation projects.

- Direct Grants and Climate Funds: Multilateral funds such as the Green Climate Fund and Global Environment Facility provide grants and concessional finance for eligible projects. Search for “Green Climate Fund application” or contact your country’s climate finance focal point for details.

- Blended Finance: Combining public, private, and philanthropic capital can de-risk climate investments and scale impact.

Step-by-Step Guidance to Getting Started

If you want to participate in climate finance or carbon markets:

- Assess your emissions or project potential, using internal audits or third-party expertise.

- Research which carbon standards and registries operate in your sector and region.

- Contact technical assistance providers such as UNDP, national climate agencies, or established NGOs for tailored support.

- Develop your project or emission reduction plan, ensuring alignment with current standards and best practices.

- Register and verify your project, working with recognized third-party auditors.

- Engage with buyers or sellers on established market platforms, prioritizing transparency and long-term impact.

For government programs and funding, consult your national environment ministry or climate finance authority. Many countries also offer online resources and contact points for climate finance support-search for “[country name] climate finance support” for official channels.

Key Takeaways and Next Steps

The convergence of climate finance and carbon markets is generating unprecedented opportunities to fund climate action, drive innovation, and achieve global sustainability targets. Whether you are a project developer, corporate sustainability officer, or policymaker, robust engagement with high-integrity carbon markets can unlock new value while advancing the net-zero transition.

To take action:

- Stay informed through reputable agencies and consult verified resources for guidance.

- Prioritize transparency, co-benefits, and robust verification in all carbon market activities.

- Explore alternative financing mechanisms and partnerships for broader impact.

For further information, visit the United Nations Development Programme, The Nature Conservancy, or national government climate agencies. Consider joining professional networks or attending climate finance workshops and webinars for the latest insights and practical strategies.

References

- Xpansiv (2025). Carbon Markets Merge: Why 2025 Will Be a Pivotal Year for Climate Finance and Impact.

- UNDP Climate Promise (2024). Carbon Markets: Overview and Support.

- UNDP Climate Promise (2024). What Are Carbon Markets and How Do They Work?

- Green Central Banking (2025). Carbon Markets and Unlocking Green Finance for the Global South.

- The Nature Conservancy (2024). What Are Carbon Markets and How Do We Work With Them?

MORE FROM smartsavingsfinder.com