Navigating the Future of Global Wealth Distribution: Trends, Opportunities, and Strategies for Growth

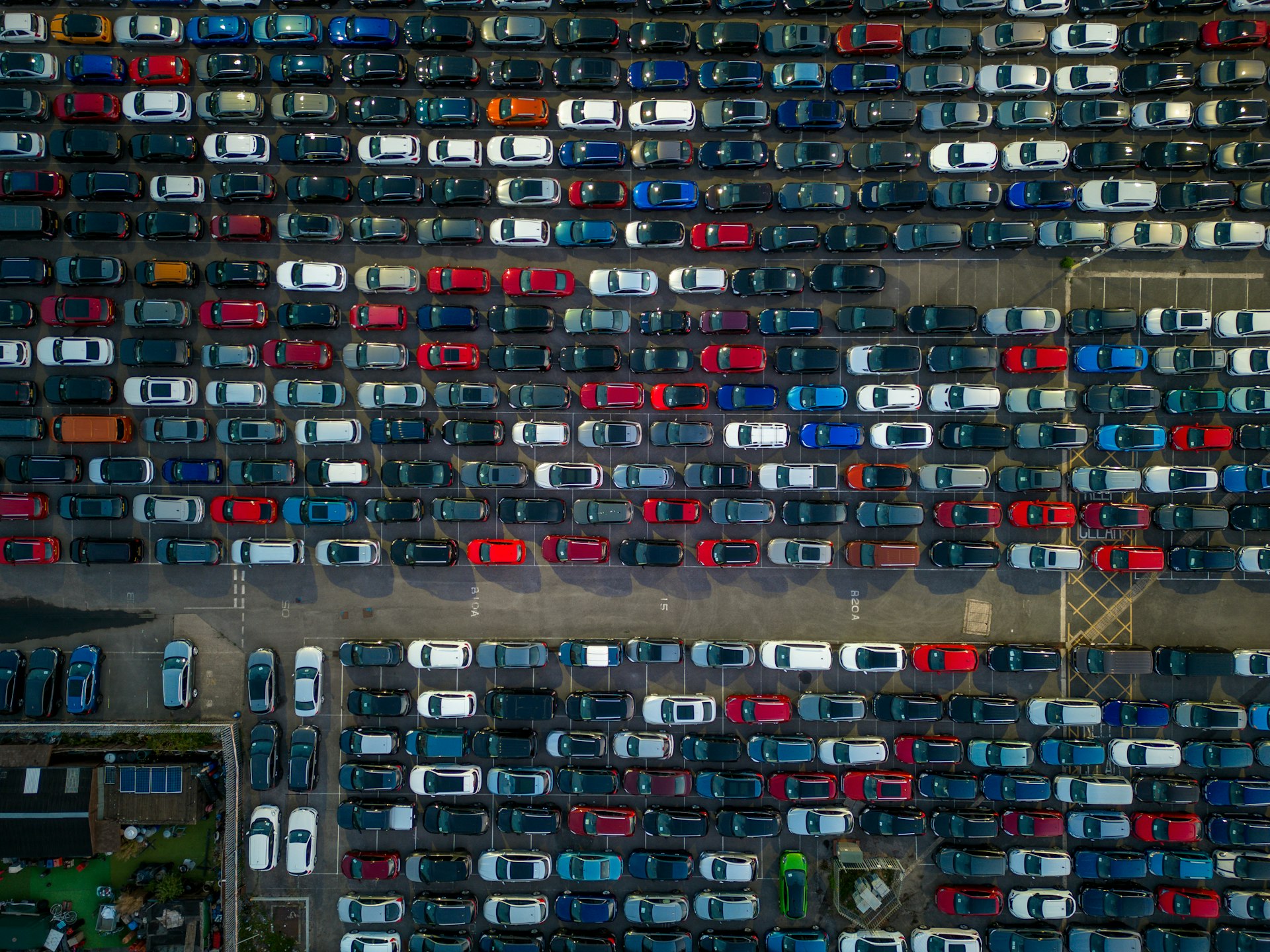

Photo by Kamran Abdullayev on Unsplash

Introduction: Understanding the Dynamics of Global Wealth Distribution

Global wealth distribution is entering a period of significant transformation, fueled by generational shifts, technological innovation, and evolving policy landscapes. Recent reports highlight both remarkable growth and persistent inequality, with the Americas and Asia leading in wealth creation while Africa is poised for future acceleration. For individuals, businesses, and family offices, understanding these trends is critical for seizing new opportunities and mitigating emerging risks. [1] [2]

Recent Trends in Global Wealth Growth

The UBS Global Wealth Report 2025 reveals that overall global wealth grew by 4.6% in USD terms in 2024, marking a steady recovery from previous years. The Americas accounted for 39% of all global wealth, with particularly rapid expansion in the United States, which saw its millionaire population grow by 78% over the past decade. The U.S. now houses 34% of global liquid wealth and 37% of the world’s millionaire population, demonstrating its continued dominance in wealth accumulation. [1] [3]

Asia is forecasted to outpace North America in future wealth creation, thanks to its expanding economies, growing middle class, and a surge in entrepreneurial activity. Africa, despite holding a smaller share of global wealth, is set to outperform in terms of growth rate, driven by its young population, resource wealth, and rising foreign investment. [4] [5]

Generational Wealth Transfer: The $83 Trillion Opportunity

One of the defining trends in the coming decades is the anticipated transfer of over USD 83 trillion in wealth between generations globally. This “great wealth transfer” will see USD 9 trillion move horizontally-between spouses-and USD 74 trillion move vertically, from older to younger generations. The United States leads this shift, with more than USD 29 trillion expected to change hands, followed by major transfers in Brazil and China. [1] [2]

For families and investors, preparing for this shift involves strategic estate planning, intergenerational education, and leveraging professional guidance. Family offices and wealth managers are focused on optimizing asset allocation, tax strategies, and succession planning to ensure a smooth transition and preservation of legacy. [5]

Shifting Asset Allocation and Investment Strategies

Generational perspectives on asset allocation are changing the investment landscape. Millennials tend to concentrate their wealth in consumer durables, real estate, and private businesses, while Baby Boomers hold the majority in financial assets and pensions. Globally, allocation patterns vary: the United States favors financial investments; Australia emphasizes real estate; and Singapore invests heavily in insurance and pensions. [2]

Private investors and family offices are increasingly diversifying portfolios by exploring alternative assets, such as luxury real estate, ESG investments, and digital nomadism opportunities. To capitalize on these trends, individuals should:

- Assess risk tolerance and long-term goals with the help of financial advisors.

- Research emerging markets and sectors poised for growth (Africa’s middle class, Asian tech startups).

- Consider international diversification by evaluating residence and citizenship-by-investment programs through established providers.

- Monitor regulatory changes affecting cross-border investments and taxation.

Wealth Migration and Global Citizenship Strategies

The rise of wealth migration is reshaping the global distribution of high-net-worth individuals. In 2025, more than 30% of investment migration applications have been filed by U.S. citizens seeking alternative residence or citizenship options, reflecting a trend toward risk management and enhanced global mobility. [3]

To explore citizenship-by-investment opportunities, individuals should:

- Consult established firms specializing in investment migration, ensuring they are regulated and reputable.

- Review official government websites of destination countries for program eligibility and requirements.

- Evaluate tax, legal, and lifestyle impacts before pursuing alternative citizenship.

- Seek legal counsel for complex cross-border planning.

If you are considering such programs, always verify opportunities through official government websites or internationally recognized advisory firms. Avoid any unverified or unofficial portals.

Policy Changes and the Tax Response

Governments worldwide are responding to growing private wealth by reassessing tax regimes and introducing new policies aimed at wealth redistribution. The UK recently abolished its non-domiciled tax regime, and France has taken steps to target the wealthy with new tax measures. The UN Convention on International Tax Cooperation could have significant implications for global wealth taxation, although its impact will depend on adoption and enforcement. [4]

For individuals and businesses, it is crucial to:

- Stay informed about changes in tax laws by following updates from official government agencies and reputable financial news sources.

- Engage with tax advisors to optimize global tax exposure and compliance.

- Consider the mobility of assets and the potential impact of new regulations on cross-border investments.

Technology, AI, and the Wealth Creation Boom

Technological advancement, especially in artificial intelligence, is fueling new avenues for wealth creation and distribution. While the much-heralded AI-powered boom is still unfolding, the U.S. and China are positioned to benefit most from its impact. Investors are increasingly allocating capital to tech startups, AI ventures, and innovative industries, while monitoring for potential bubbles and volatility. [4] [5]

To participate in technology-driven opportunities:

- Track industry trends through reputable financial publications and official market reports.

- Invest in diversified funds or directly in companies leading AI, fintech, and digital transformation.

- Monitor risk and growth potential with regular portfolio reviews.

Accessing Wealth-Building Opportunities: Step-by-Step Guidance

To access wealth-building services and opportunities in the current landscape, you can:

- Consult a certified financial planner to assess your current wealth profile and future goals.

- Review the latest global wealth reports from leading institutions such as UBS, Knight Frank, and Henley & Partners for actionable insights.

- Attend industry conferences or webinars on wealth management and global investing (often announced on verified company or event websites).

- Search for official investment migration programs via government agency websites of your target countries, using terms like “citizenship by investment” or “residence by investment”.

- Connect with established family offices or wealth management firms in your region for personalized advice.

- Monitor updates on international tax regulations via official sources such as the OECD and national tax authorities.

If seeking specific services, always verify the provider’s credentials, regulatory status, and reputation before engaging. For government programs, use official agency names and recommended search terms to locate the correct portal and application process.

Challenges and Alternative Approaches

Despite strong growth, global wealth distribution faces challenges including persistent inequality, market uncertainty, and regulatory complexity. Some regions, like Africa, are surging in growth but lag in absolute wealth, while established markets contend with volatility and potential policy headwinds.

Photo by Kevin Grieve on Unsplash

Alternative approaches to wealth-building include:

- Impact investing and supporting sustainable development projects in emerging markets.

- Participating in ESG-focused funds for long-term resilience and social impact.

- Leveraging digital platforms for global investment opportunities, ensuring platforms are regulated and secure.

Conclusion: Key Takeaways for the Future of Wealth Distribution

Global wealth distribution is characterized by dynamic growth, demographic shifts, and evolving investment strategies. By staying informed, leveraging professional guidance, and pursuing diversified pathways, individuals and businesses can position themselves for lasting success in an increasingly complex and interconnected world.

References

MORE FROM smartsavingsfinder.com