Navigating Geopolitical Tensions: How Global Markets Respond and What You Can Do

Photo by Ergin Güçlü on Unsplash

Understanding the Impact of Geopolitical Tensions on Global Markets

Geopolitical tensions, including conflicts, trade disputes, and shifting alliances, are reshaping the landscape of global markets. These developments introduce significant volatility, disrupt trade flows, and challenge established investment strategies. As the frequency and complexity of such risks rise, individuals and organizations must adapt to protect assets and seize emerging opportunities. [1]

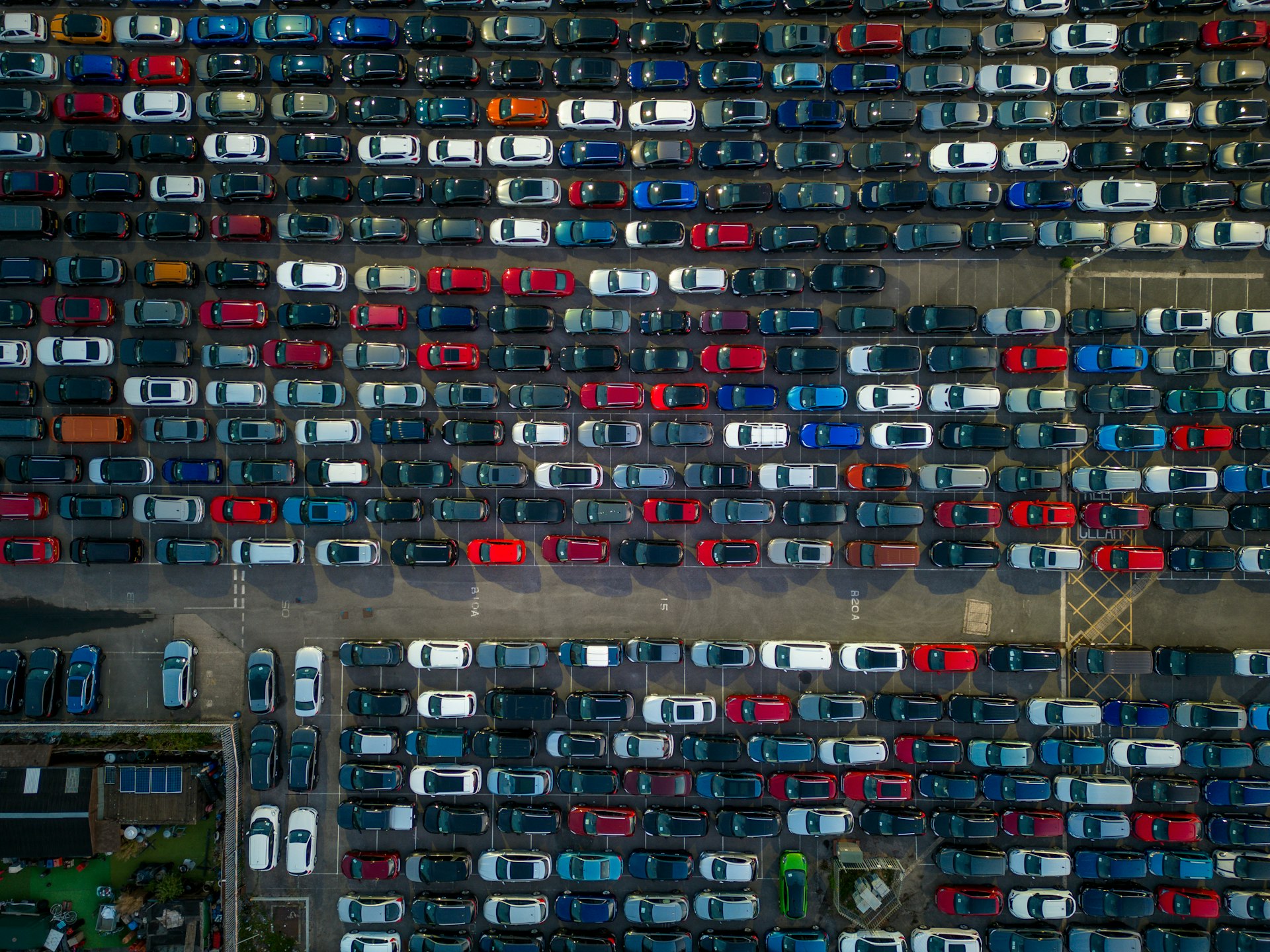

Photo by Benjamin Smith on Unsplash

1. Economic Growth and Inflation Dynamics

Recent years have demonstrated how conflicts-such as the Russia-Ukraine war and ongoing US-China tensions-directly impact both global growth and inflation. Disruptions to energy and food supplies often elevate prices worldwide, resulting in inflation rates that remain above pre-pandemic norms. This persistent inflation can erode purchasing power and increase costs for businesses and consumers alike. [1]

Central banks have responded by moderating rate cuts, keeping policy rates and sovereign bond yields higher than historical averages. For investors and businesses, this means elevated borrowing costs and a heightened need for risk assessment when planning growth or expansion. [1]

2. Supply Chain Disruptions and Trade Volatility

Geopolitical tensions routinely disrupt supply chains, as evidenced by recent increases in tariffs and the imposition of trade restrictions. The uncertainty surrounding new tariffs-such as the proposed 60% tariffs on Chinese imports in the US-has forced companies to reroute shipments, stockpile inventory, or absorb higher transport costs. Such actions not only increase operational expenses but also contribute to greater market volatility, especially in sectors reliant on cross-border trade. [5] Smaller exporters and developing economies are particularly vulnerable, lacking the resources to buffer these shocks. The World Trade Policy Uncertainty Index reached record highs in early 2025, highlighting the deeply embedded nature of this unpredictability in today’s markets. [5]

For those seeking to monitor or adapt to these trends, you can follow updates from the United Nations Conference on Trade and Development (UNCTAD) or consult your industry’s trade association for targeted guidance.

3. Asset Prices and Investment Strategies

Periods of heightened geopolitical risk have a measurable effect on asset prices. Stock markets typically experience immediate declines, with emerging market equities being the most sensitive. According to the International Monetary Fund, major risk events lead to an average monthly drop of about 1 percentage point in global stocks, with emerging markets seeing drops as high as 5 percentage points during international military conflicts. [3]

Investors often respond by reallocating to defensive sectors such as utilities and healthcare, while using hedges like gold or government bonds to protect portfolios. However, these approaches require regular reassessment as market conditions evolve. For actionable strategies, consider consulting with a licensed financial advisor and reviewing the latest analysis from reputable financial news outlets.

4. Financial Sector Risks and Operational Resilience

Banks and financial institutions are particularly exposed to geopolitical shocks, which can increase credit, liquidity, and operational risks. For example, the fragmentation caused by tariffs or sanctions may rapidly deteriorate asset quality, especially if trust among nations erodes. The rise of cyber-attacks-amplified by geopolitical antagonism-adds another layer of operational and reputational risk. [4] The share of European banks reporting successful cyber-attacks has nearly tripled since 2022, demonstrating the urgency of robust risk management and cybersecurity practices within the financial sector. [4]

Organizations should prioritize scenario planning and invest in resilient systems. For those in the finance sector, consult your institution’s risk management division and consider subscribing to updates from your region’s financial regulatory authority for the latest compliance standards.

5. Currency Fluctuations and Capital Flows

Geopolitical uncertainty often triggers volatile swings in currency markets. For example, the US dollar may depreciate due to weaker domestic growth and narrowing interest rate differentials, although it remains a dominant global reserve currency. [1] In developing economies, currency instability can lead to tighter capital flows, higher borrowing costs, and increased sovereign risk premiums-sometimes up to four times higher than in advanced economies. [3]

Businesses and investors can manage currency risks through hedging instruments or by diversifying across currencies and geographies. For guidance on currency risk management, you may consult with a treasury specialist or visit the official website of your country’s central bank for policy updates.

6. Sector Rotation and Strategic Positioning

Political cycles, such as U.S. midterm elections, can accelerate shifts in policy and sector performance. For instance, increased tariffs and trade barriers may strain cyclical sectors like technology and manufacturing, while defensive areas (utilities, healthcare) tend to outperform during periods of instability. [2] Investors should regularly reassess sector exposure and consider both hedging strategies and growth opportunities in areas like AI or infrastructure, which may benefit from policy-driven investments.

For up-to-date insights, review sectoral analyses from established financial services providers or industry reports from consulting firms such as Deloitte. When in doubt about the reliability of investment advice, always verify the credentials of your source.

7. Accessing Resources and Implementing Resilient Strategies

To navigate geopolitical risks, organizations and individuals can take several actionable steps:

- Monitor updates from global organizations, such as the International Monetary Fund, UNCTAD, and the World Bank, for macroeconomic trends and risk assessments.

- Engage with industry associations for guidance on sector-specific disruptions and regulatory changes.

- Consult with licensed financial professionals to tailor risk management and investment strategies.

- Implement robust scenario planning and cybersecurity measures, especially for businesses exposed to international markets.

- For small exporters or businesses in developing economies, seek support from export credit agencies or trade finance providers listed on your official government trade portal.

If you require direct assistance, you can reach out to your local chamber of commerce or industry regulator for referrals to qualified professionals.

8. Challenges and Alternative Approaches

One of the primary challenges in managing geopolitical risk is the unpredictability and rapid evolution of these events. Traditional forecasting models may not capture the full range of potential outcomes, making real-time monitoring and agile decision-making essential. Some organizations employ specialized geopolitical risk consultants or subscribe to risk intelligence platforms for tailored analysis.

Alternatives include building flexible supply chains, diversifying market exposure, and leveraging digital platforms to adapt quickly to changing regulatory environments. While these approaches can mitigate risk, they often require significant upfront investment and ongoing vigilance.

Key Takeaways

Geopolitical tensions are an enduring feature of today’s global markets, with far-reaching implications for trade, financial stability, investment, and supply chains. By staying informed, leveraging expert advice, and adopting resilient strategies, individuals and organizations can better navigate uncertainty and position themselves for long-term success.

References

- [1] S&P Global (2025). Top Geopolitical Risks of 2025: Impacts on Economic Outlook and Markets.

- [2] AInvest (2025). Geopolitical Risk and Its Impact on Global Markets: Strategic Sector Positioning.

- [3] IMF Blog (2025). How Rising Geopolitical Risks Weigh on Asset Prices.

- [4] Informa Connect (2025). Geopolitical Risk in 2025: From Fragmentation to Financial Fallout.

- [5] UNCTAD (2025). Uncertainty is the New Tariff: Costing Global Trade and Hurting Developing Economies.

MORE FROM smartsavingsfinder.com