How Geopolitical Tensions Are Reshaping Automotive Supply Chains: Challenges and Solutions for 2025

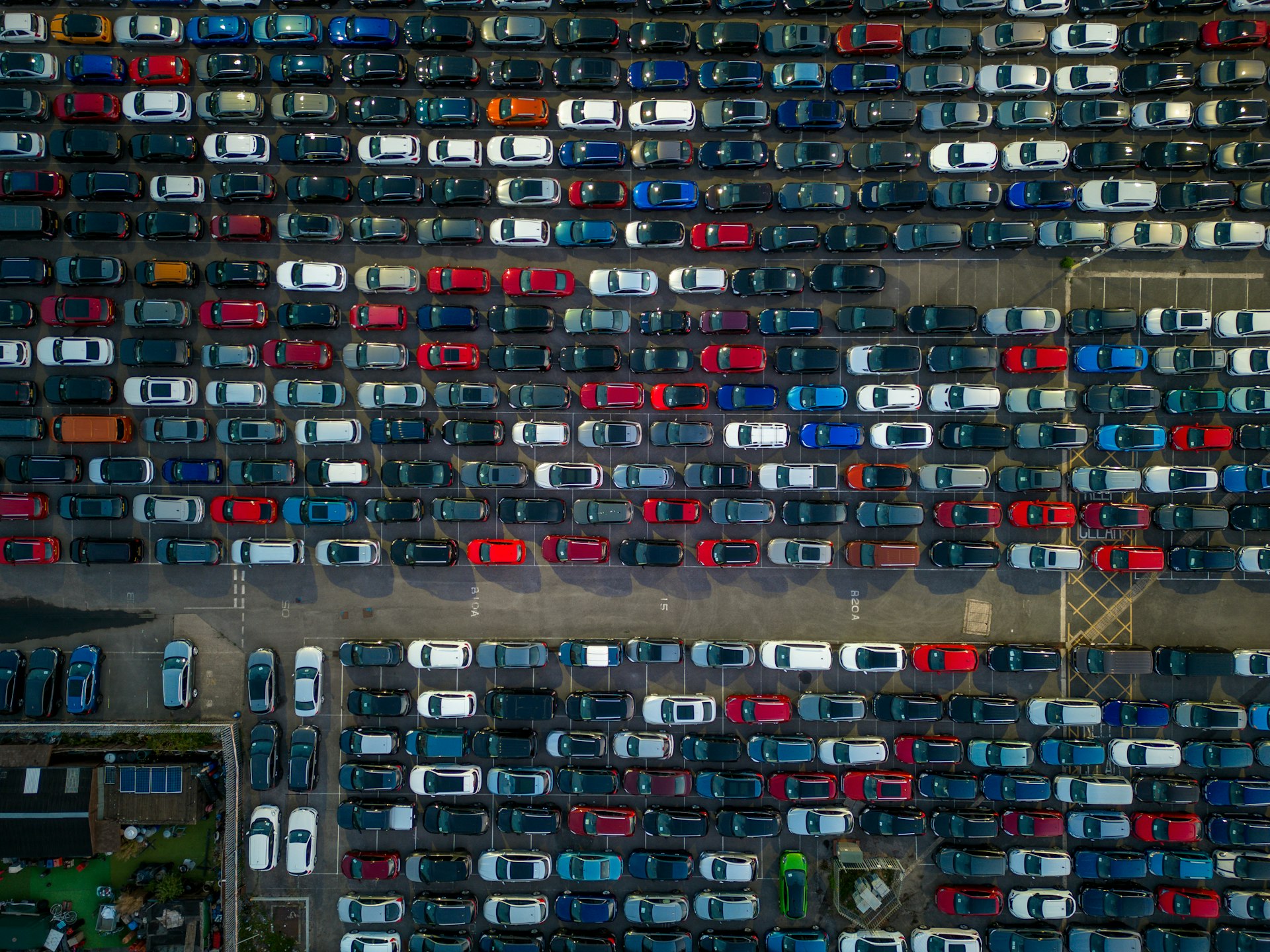

Photo by Ed Wingate on Unsplash

Introduction: The New Reality of Automotive Supply Chains

The automotive industry has always depended on complex, cross-border supply chains. In 2025, however, geopolitical tensions and sudden shifts in trade policy are driving unprecedented disruption. Manufacturers, suppliers, and logistics providers now face a challenging landscape of rising tariffs, regulatory changes, and unpredictable market dynamics. Understanding these impacts-and learning how to respond-has become essential for business survival and growth. [1] [2]

Major Causes of Disruption: Tariffs, Trade Wars, and Political Uncertainty

The most visible recent trigger for automotive supply chain upheaval is the implementation of new tariffs . In March 2025, the U.S. administration announced a 25% tariff on all imported automobiles and auto parts, effective April 3. This move was designed to boost domestic manufacturing but has instead increased costs for automakers reliant on international component flows. Vehicles assembled in Canada or Mexico that do not meet specific USMCA (United States-Mexico-Canada Agreement) requirements now face these tariffs, disrupting the deeply integrated North American automotive market. [1]

The financial impact is significant. According to the Center for Automotive Research, these tariffs could cost U.S. automakers nearly $108 billion. Major companies such as Ford, General Motors, and Stellantis are particularly exposed due to their extensive global sourcing. [1] Some manufacturers, like Hyundai, are already considering price increases across their vehicle lineups to offset these new costs.

Beyond tariffs, trade disputes and political instability -including shifting U.S. relations with China, Mexico, and Europe-further complicate sourcing strategies. Ongoing wars and regional conflicts also threaten the supply of critical raw materials like steel, disrupt transportation routes, and limit labor availability. [4]

Supply Chain Impacts: Cost, Complexity, and Delays

These geopolitical tensions result in several specific challenges:

- Increased production costs as tariffs raise the price of imported components and raw materials.

- Longer lead times and shipment delays due to rerouted logistics and increased border inspections.

- Sourcing uncertainty as companies scramble to find alternative suppliers or shift production locations.

- Regulatory and compliance risks from new trade agreements, labor standards scrutiny, and political interventions.

For example, after the U.S. imposed new tariffs, automakers including Hyundai and Honda redirected vehicle production from Mexico to the U.S. (Alabama and Indiana, respectively), while Ford raised prices on vehicles built in Mexico. General Motors projected a $4-5 billion tariff impact and announced a $4 billion investment in U.S. plants to reshore production. [3]

Photo by Anna Keibalo on Unsplash

Meanwhile, European automakers are grappling with overcapacity and stagnant demand, forcing job cuts and plant closures. China has rapidly become the world’s largest vehicle exporter, restructuring global trade routes and challenging traditional logistics providers. [2]

Case Study: EV Battery Supply Chains Under Pressure

The electric vehicle (EV) sector is especially vulnerable to geopolitical shocks. EV battery production relies on a handful of countries for key materials-like lithium, nickel, and cobalt. Trade restrictions or political conflict in these regions can quickly create global shortages and price spikes. According to a recent industry survey, 47% of automotive executives cite securing EV battery materials as a top challenge for 2025. [5]

To address these risks, many automakers are actively diversifying their supplier base and investing in alternative sourcing strategies. However, this transition requires time and significant capital, often resulting in short-term instability and higher costs for both manufacturers and consumers.

Building Resilience: Strategies for Automotive Companies

In response to these disruptions, industry leaders are pursuing several resilience-building strategies:

- Nearshoring and reshoring : Moving production closer to core markets to reduce cross-border exposure, as seen with Hyundai and GM shifting operations back to the U.S. [3]

- Diversifying suppliers : Sourcing raw materials and components from multiple regions to avoid overreliance on any single country or supplier. [5]

- Contract renegotiation and clarity : Regularly reviewing and updating contract terms to account for tariff shifts, regulatory changes, and delivery obligations. [5]

- Enhanced supply chain visibility : Using digital tools and advanced analytics to monitor risk, track shipments, and quickly respond to disruptions.

For suppliers and OEMs, the first step is to conduct a thorough risk assessment of current supply chain dependencies. Next, companies should develop contingency plans for alternative sourcing, establish clear escalation protocols with logistics partners, and routinely review trade compliance requirements.

When exploring new suppliers, companies should prioritize those with a track record of reliability, proven compliance with labor and environmental standards, and flexible logistics capabilities. Industry associations and trade groups may also offer resources and networking opportunities for identifying reputable partners.

Implementation Guidance: Steps for Building a Resilient Supply Chain

To successfully adapt to ongoing geopolitical volatility, automotive companies can:

- Map your entire supply chain -including sub-tier suppliers-to identify geographic and political exposure.

- Monitor trade policy developments using trusted news outlets, official government communications, and industry briefings.

- Regularly renegotiate contracts to include clear terms on tariffs, delivery obligations, and dispute resolution.

- Invest in digital visibility tools for real-time shipment tracking and risk management.

- Engage with logistics providers to assess alternative shipping routes and modes in response to bottlenecks.

- Consider nearshoring or dual-sourcing high-risk components, especially for EV batteries and critical electronics.

For companies seeking vetted suppliers or logistics support, you can consult your national automotive trade association or chamber of commerce for referrals. Additionally, industry conferences and trade shows often provide opportunities to meet new partners and learn about emerging best practices.

If you are unsure about accessing official trade or tariff information, visit the official website of the U.S. Department of Commerce or your country’s equivalent agency and search for the latest automotive trade updates. For EV material sourcing, consider following updates from the International Energy Agency and industry news outlets.

Challenges and Alternative Approaches

While supply chain diversification and nearshoring can reduce some risks, they often come with higher upfront costs and operational complexity. Smaller suppliers may struggle to compete on price or volume, and shifting production locations can disrupt established business relationships.

To address these challenges, some companies are forming joint ventures or alliances to pool resources and increase bargaining power with suppliers. Others are investing in automation and smart manufacturing to offset higher labor and logistics costs. In all cases, flexibility and proactive planning are key to navigating the ongoing volatility.

Conclusion: Preparing for an Uncertain Future

The impact of geopolitical tensions on automotive supply chains is profound and ongoing. Companies that invest in resilience, diversification, and proactive risk management will be best positioned to weather future disruptions. By staying informed and adaptable, automotive businesses can turn today’s challenges into tomorrow’s opportunities.

References

- [1] TSET (2025). Cost Management Under Geopolitical Pressure: 2025 Tariffs.

- [2] Automotive Logistics (2025). Automotive logistics and supply chains in 2025.

- [3] Automotive Logistics (2025). Automotive supply chains in flux: 2025 outlook and trends.

- [4] Boise State University (2025). The U.S. Automotive Industry Supply Chain: Challenges and Transformations.

- [5] Dykema (2025). 2025 Automotive Trends Report: Supply Chain.

MORE FROM smartsavingsfinder.com